Home Home

Home

Most Discussed

Here are the some multi-choice questions enlisted for preparation for Pre Examination online Test, E-Learning ICSI & LAWs Law Examination. These Multi-choice questions or MCQs can help you in your CS & CA and other law related exams. We...

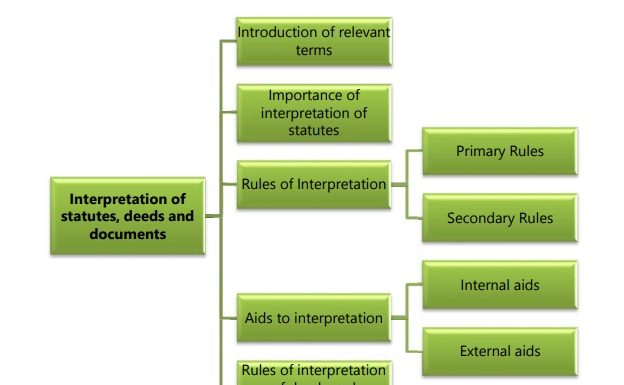

Interpretation of statutes is the correct understanding of the law. This process is commonly adopted by the courts for determining the exact intention of the legislature. Because the objective of the court is not only merely to read the law...

Paying income tax for the very first time is a milestone for everybody who earns or will get an income in India and is topic to income tax. However for the rookies or first-timers, income tax return filing could...

Most Visited

- All

- Arbitration Act

- Article

- case law

- Commerce & Industry

- Constitution

- Corporate law

- corporate restructuring

- Covid 19

- criminal procedure code

- Digital Signature

- Education

- External Affairs

- Filing

- Finance

- GST

- Home Affairs

- ICAI

- ICMAI

- ICSI

- ICSI.EDU

- Income Tax

- Income Tax

- IRDAI

- Labour and Employment

- Law and Justice

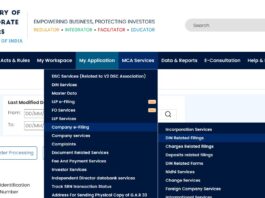

- MCA

- mca.gov.in

- MSME

- Multi-choice Questions(MCQ)

- NCLAT

- NCLT

- negotiable instrument act

- Notification

- RBI

- rbi.org.in

- Recovery of Debts and Bankruptcy Act

- SEBI

- sebi.org.in

- Skill Development & Entrepreneurship

- Startups

- Women & Child Development

More

Random

How to register a Digital Signature Certificates under GST Portal in India.

Earlier than registering the Digital Signature certificates within the Licensed signatory tab web page enter the small print of all of the approved signatures.

As...

Consent Letter Format for GST registraion

Consent Letter means the place of business is a rented premise or the taxpayer uses the premises of a relative. The owner of the...

Insolvency Resolution and Liquidation for Corporate Persons

Insolvency Resolution and Liquidation for Corporate Persons means the Corporate Insolvency Resolution Process ('CIRP') is a recovery mechanism for the creditors of a corporate...

Due dates for GST Returns & IT Returns for June & July 2020

Due dates for GST Returns and Income Tax Returns for the Month of June 2020 and July 2020- As prolonged

The Month of June and...

Contact Ushttps://perfectfiling.com/category/notification/