What’s Tax Audit?

The dictionary which means of the time period “audit” is verify, evaluate, inspection, and so forth. There are numerous sorts of audits prescribed beneath completely different legal guidelines like firm regulation requires an organization audit, price accounting regulation requires a price audit, and so forth. The Income-tax Regulation requires the taxpayer to get the audit of the accounts of his enterprise/career from the view level of Income-tax Regulation. The audit performed by the chartered accountant of the accounts of the taxpayer in pursuance of the requirement of Part 44AB known as tax audit.

What’s the Tax audit Part 44AB?

- The audited accounts should be reported by a Chartered Accountant within the prescribed kinds.

- The audit report ought to be inclusive of the findings, observations and so forth.

- Audit report in respect of audit performed beneath Part 44AB should be ready in Type No. 3CB and the particulars of the audit should be reported in Type 3CD.

-

Part 44AB provides the provisions referring to the category of taxpayers who’re required to get their accounts audited by a chartered accountant.

-

The audit beneath part 44AB goals to establish the compliance of assorted provisions of the Income-tax Regulation and the achievement of different necessities of the Income-tax Regulation.

-

The tax audit restrict beneath part 44AB is INR 1 Crores.

Vital: 44AB restrict continues to be 1 Crore (besides specified under), and 44AD has restrict of Rs. 2 Crores. Additionally, in Part – 44AD, which offers with Particular provision for computing income and beneficial properties of enterprise on presumptive foundation.

Applicability beneath part 44AB:

-

Any particular person pursuing enterprise and whose whole turnover or gross receipts exceed a sum of two Crore rupees in any earlier yr (Nevertheless, this provision shouldn’t be relevant to the individuals who opts for presumptive taxation scheme).

-

Any particular person pursuing a career and whose gross income exceed fifty Lakh rupees in any earlier yr.

-

An individual who is taken into account eligible for the presumptive taxation scheme, and who claims that the income and beneficial properties for the respective enterprise is decrease than what’s computed in accordance with the presumptive taxation scheme and his/her income exceeds the quantity that’s taxable. This provision is relevant to the taxpayers who go for presumptive taxation scheme apart from the one who select the scheme beneath Part 44AD and whose sale or turnover is proscribed to Rs 2 Crores.

Detailed rationalization of the applicability of part 44AB as quoted within the Income Tax Act 1961:

As per part 44AB, the next individuals are compulsorily required to get their accounts audited:

-

An individual carrying on enterprise, if his whole gross sales, turnover or gross receipts (because the case could also be) in enterprise for the yr exceed or exceeds Rs. 1 Crore. This provision shouldn’t be relevant to the one who opts for presumptive taxation scheme beneath part 44AD and his whole gross sales or turnover doesn’t exceed Rs. 2 Crores.

Be aware that With the impact of the Evaluation Yr 2020-21, the brink restrict, for an individual carrying on enterprise, is elevated from Rs. 1 Crore to Rs. 5 Crore in case when money receipt and cost made through the yr doesn’t exceed 5% of whole receipt or cost, because the case could also be. In different phrases, greater than 95% of enterprise transactions ought to be carried out by means of banking channels.

-

A particular person carrying on career, if his gross receipts in career for the yr exceed Rs. 50 lakhs.

-

An assessee who declare revenue for any earlier yr in accordance with part 44AD and he decreases revenue for any of 1 5 evaluation yr related to the earlier yr succeeding such earlier yr decrease than the revenue computed as per part 44AD and his income exceeds the quantity which isn’t chargeable to tax.

-

If an eligible assessee opts out of the presumptive taxation scheme, inside the aforesaid interval, he can’t select to revert again to the presumptive taxation scheme for a interval of 5 evaluation years thereafter.

-

An individual who’s eligible to go for the presumptive taxation scheme of part 44ADA however he claims the income or beneficial properties for such a career to be decrease than the revenue and beneficial properties computed as per the presumptive taxation scheme and his income exceeds the quantity which isn’t chargeable to tax.

-

This provision shouldn’t be relevant to the one who opts for presumptive taxation scheme beneath part 44AD and his whole gross sales or turnover doesn’t exceed Rs. 2 Crores.

-

An individual who’s eligible to go for the taxation scheme prescribed beneath part 44BB that’s non-resident taxpayers engaged within the enterprise of offering providers or services regarding, or supplying plant and equipment on rent foundation for use in exploration of mineral oils or part 44BBB particularly international corporations engaged within the enterprise of civil development or erection of plant or equipment or testing or commissioning thereof, in reference to a turnkey energy mission however he claims the income or beneficial properties for such enterprise to be decrease than the income and beneficial properties computed as per the taxation scheme of those sections.

Be aware: Individuals like firm or co-operative society are required to get their accounts audited beneath their respective legal guidelines. Part 44AB gives that, if an individual is required by or beneath some other regulation to get his accounts audited, then he needn’t once more get his accounts audited to adjust to the requirement of part 44AB. Is such a case, it shall be enough if such particular person will get the accounts of such enterprise or career audited beneath such regulation and obtains the report of the audit as required beneath such different regulation and in addition a report by the chartered accountant within the kind prescribed beneath part 44AB, i.e., Type No. 3CA and Type 3CD.

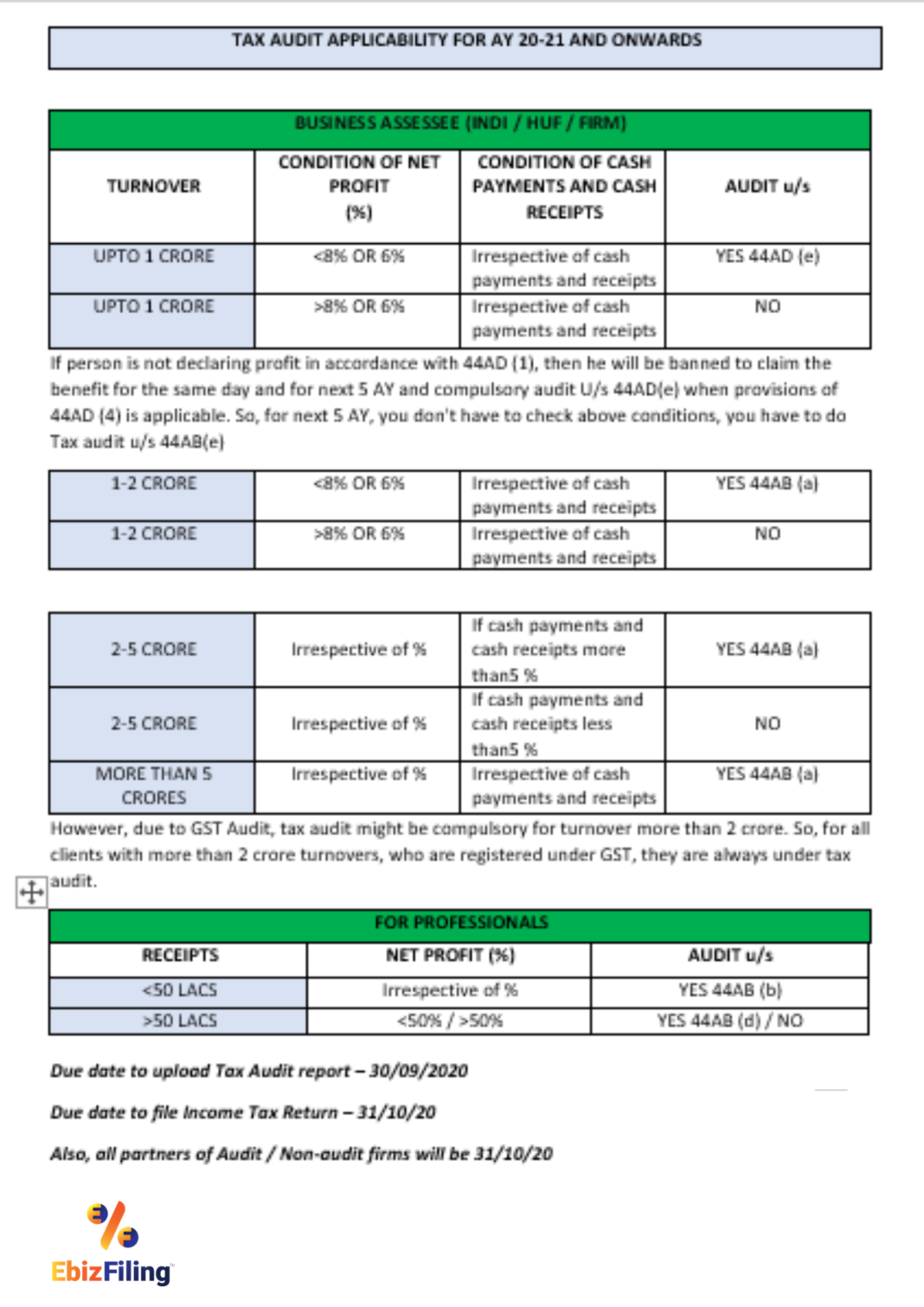

Here’s a desk exhibiting Applicability of Part 44AB for fast reference:

Kinds to be filed for Tax audit beneath part 44AB:

These are the kinds wanted to be used by people or folks when an audit is completed on their accounts as per part 44AB.

A) For individuals or people conducting enterprises the place accounts are to be audited as per these provisions:

-

Type Quantity 3CA – Audit Type

-

Type Quantity 3CD – Assertion exhibiting related particulars

B) People with accounts which aren’t required to be audited as per the provisions acknowledged beneath any regulation, apart from income tax legal guidelines, then the kinds talked about under are relevant:

-

Type Quantity 3CB – Audit Type

-

Type Quantity 3CD – Assertion exhibiting related particulars

Due date for Tax Audit beneath part 44AB:

An individual lined by part 44AB ought to get his accounts audited and may receive the audit report on or earlier than 30th September of the related evaluation yr, e.g a Tax audit report for the monetary yr 2019-20 akin to the evaluation yr 2020-21 ought to be obtained on or earlier than 30th September, 2020.

The tax audit report is to be electronically filed by the chartered accountant to the Income-tax Division. After filing of report by the chartered accountant, the taxpayer has to approve the report from his e-fling account with Income-tax Division (i.e. at www.incometaxindiaefiling.gov.in).

Penalty for non filing of Audit Report beneath Part 44AB:

If any one who is required to adjust to part 44AB fails to get his accounts audited in respect of any yr or years as required beneath part 44AB or furnish such report as required beneath part 44AB, the Assessing Officer might impose a penalty.

-

zero.5% of the entire gross sales, turnover or gross receipts, because the case could also be, in enterprise, or of the Gross receipts in career, in such years or years or,

-

Rs. 1,50,000.

Whichever is decrease of the above shall be levied as penalty on non filing of audit report beneath part 44AB

Nevertheless, no penalty shall be imposed if an inexpensive trigger for such failure is proved.

Causes accepted in case of failure of income tax audit beneath Part 44AB:

Delay of the income tax audit because of the licensed chartered accountant or auditor resigning from obligation.

-

Failure of income tax audit because of the unexpected demise of CA or auditor.

-

Failure of income tax audit because of the licensed CA or auditor not getting access to the person’s accounts. Together with situations of theft, strikes and so forth.

-

Delay of income tax audit occurs due to pure catastrophe.

In case you are a taxpayer, you need to adjust to the provisions of the part 44AB of the income tax act 1961. This part states that every one the taxpayers should get an audit report furnished after conducting an audit on your books of accounts by a working towards chartered accountant.