LLP annual filings:

Each Restricted Legal responsibility Partnerships (LLPs) is required to file its annual return inside 60 days from the top of the monetary 12 months and Assertion of Account & Solvency inside 30 days from the top of six months of the shut of the monetary 12 months.

Other than this, Data with regard to any change in LLP settlement is required to be filed inside 30 days of such change with ROC. Additionally, Discover of appointment, cessation, change in identify/ deal with/designation of a delegated accomplice or accomplice and consent to turn out to be a accomplice/designated accomplice shall be filed with ROC in Type four inside 30 days of such appointment/cessation, because the case could also be.

Earlier If there was a delay in filing Form 8 and Form 11 of LLP, penalty of Rs. 100 per day per kind was payable from the due date of filing return until the date the precise return is filed.

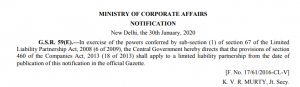

MCA vide its latest Notification has now prolonged the provisions of Part 460 to LLPs which might imply that now Restricted Legal responsibility Partnerships even have the choice of continuing earlier than the Central Authorities on account of any delay in filing an software/ doc with the Central Authorities or Registrar respectively. Meaning the penalties for late filing charges of LLP Type three, Type eight and Type 11 could also be condoned after recording the cheap motive in writing.

Condonation of delay- Part 460 of the Corporations’ Act:

Condonation of Delay is a Scheme to offer one remaining alternative to the administrators of the defaulting corporations who because of the motive of the non-filing of monetary statements and annual returns had been held liable and disqualified.

Earlier whereas this privilege was out there to corporations solely, with the newest notification issued by MCA this directive will likely be relevant to LLPs additionally, which means thereby, administrators of LLPs will now get the good thing about condoning the delay.

See the Notification on Amnesty Scheme for Condonation of Delay for LLPs beneath:

Let’s research what Part 460 of the Corporations Act has to say on this regards:

Part 460 underneath the Corporations Act 2013, states that,

- The place any software required to be made to the Central Authorities underneath any provision of this Act in respect of any matter just isn’t made throughout the time specified therein, that Authorities might, for causes to be recorded in writing, condone the delay; and

- The place any doc required to be filed with the Registrar underneath any provision of this Act just isn’t filed throughout the time specified therein, the Central Authorities might, for causes to be recorded in writing, condone the delay.

Late charges for LLP filings will likely be lowered:

The scheme will enable those that haven’t filed LLP types three and four in addition to types eight and 11 to file the returns with an extra payment of Rs 10 a day with an general cap of Rs 5,000. Presently, for every day of delay in filing any of those types, the penalty is Rs 100 a day.

Know: The important Statutory due dates for LLP Annual filings

The transfer is supposed to make life simpler for companies and assist them treatment issues that they might be going through as a result of non-filing of returns. It’s an amazing step to stop the miscarriage of justice taken by the ministry to condone the delay when the delay is occasioned for the explanation past the management till the lawbreakers doesn’t benefit from it.