Consent Letter means the place of business is a rented premise or the taxpayer uses the premises of a relative. The owner of the premises must sign the consent letter.

If the premises are rented, then a valid rent/lease agreement is to be uploaded. If it’s neither owned nor rented, then such taxpayers are required to submit a consent letter at the time of upload of their proof of place of business.

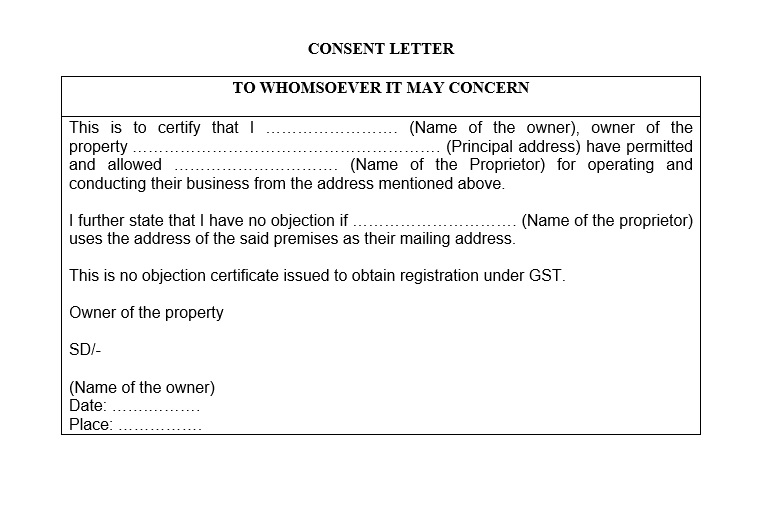

Format of a consent letter

CONSENT LETTER

TO WHOMSOEVER IT MAY CONCERN

This is to certify that I ……………………..(Name of the owner), owner of the property …………………………………………………. (Principal address) have permitted and allowed …………………………. (Name of the Proprietor) for operating and conducting their business from the ADDRESS MENTIONED ABOVE.

I further state that I have no objection if …………………………. (Name of the proprietor) uses the address of the said premises as their mailing address.

This is no objection certificate issued to obtain registration under GST.

Owner of the property

Sd/-

(Name of the owner)

Date: …….……….

Place: …………….

FAQ on basis of Consent Letter:

Question1: Is the trade name of the proprietor needed in the consent letter?

Answer: No, the trade name of the sole proprietor is not required to be mentioned in the consent letter.

Question 2: What type of stamp paper is required for GST registration NOC?

Answer: Not all of the applicants need to submit the NOC on stamp paper. They can use normal paper. Only if the jurisdictional officer insists on submitting it on the stamp paper, they can go for it.

Question 3: Why is NOC required for GST registration?

Answer: NOC or consent letter is needed for GST registration of such taxpayers who are neither doing business on their own premises nor doing business in rented premises. e.g. Mr. Ram is staying with his parents in their own flat. He starts his practice as a chartered accountant and wants to obtain GST registration. He does not have any other place of business as he works from home. In this case, he must obtain the signed consent letter from his parents.

Question 4: How do I write a business consent letter?

Answer: You can download the consent letter format provided in the above section, and fill up the details of the owner and your business. Thereafter, obtain their signature.

Question 5: Does a rent agreement need to be notarized for GST registration?

Answer: No, you do not need to notarized the consent letter unless insisted so by the jurisdictional officer who is processing your GST registration application.

Question 6: What is Consent Letter?

Answer: Consent Letter means the place of business is a rented premise or the taxpayer uses the premises of a relative.

Question 7: Who must sign the consent letter?

Answer: The owner of the premises must sign the consent letter. In some cases, GST officers ask for a consent letter on a stamp paper, and the same should be notarised as well. However, one can upload the consent letter without even printing it on stamp paper. If a GST officer specifically asks for the content letter to be printed on stamp paper, the taxpayer can get the needful done.

Question 8: Failure to submit a consent letter?

Answer: Suppose a taxpayer forgets to submit the consent letter and the address proof while filing the GST registration application in Form GST REG-01.

In that case, the GST officer will communicate with the taxpayer via email or phone. On receiving such communication, a taxpayer can attach the consent letter to the application.

Question 9: Steps to upload the consent letter

Answer: Steps to upload the consent letter

Step 1: Visit the GST portal and go to ‘Services’ -> ‘Registration’ -> ‘New Registration’.

Step 2: While filling up the form, select ‘Consent’ under the nature of possession of premises.

Step 3: The consent letter can be uploaded in PDF or JPEG format, but the file size cannot be more than 100KB.

Question 10: Other documents with consent letter

Answer: The consent letter should be uploaded along with address proof of business like a Municipal Khata copy or an electricity bill.

Question 11: Meaning of GST consent letter or NOC

Answer: Many businesses are carrying out their work from home as they do not have a registered commercial place of business. If such premises on which work is being carried out is owned, then a document supporting the taxpayer’s ownership is to be uploaded at the time of registration.

If the premises are rented

then a valid rent/lease agreement is to be uploaded. If it’s neither owned nor rented, then such taxpayers are required to submit a consent letter at the time of upload of their proof of place of business.

No Objection Certificate

It is a No Objection Certificate (NOC) from the owner of the premises stating that he doesn’t have any objection to the taxpayer using the premises for carrying out business. Under GST, there is no specific format for the consent letter. It can be any written document.

[…] Consent Letter Format for GST registraion […]

Comments are closed.