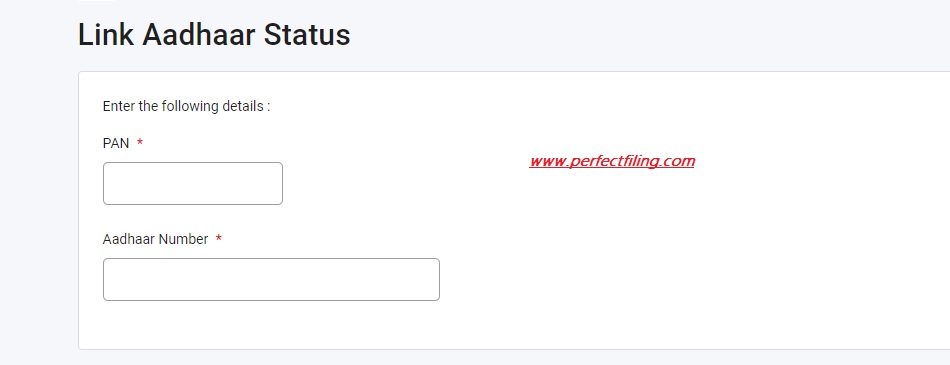

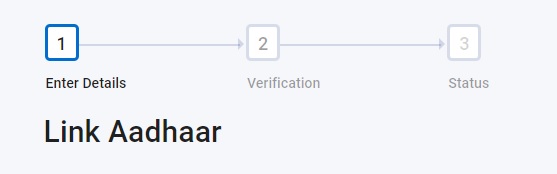

Aadhaar-PAN linking and Know Your Payment Status is based on the 30.06.2023 ” 30th June, 2023. There is no need of downloading of the challan receipt for linking PAN with Aadhaar. Further, as soon as PAN holder completes the payment successfully, an email with an attached copy of the challan is already being sent to the PAN holder.

Following categories are exempted from Aadhaar-PAN linking

(i) NRIs

(ii) Not a citizen of India

(iii) age > 80 years as on date

(iv) state of residence is ASSAM, MEGHALAYA or JAMMU & KASHMIR

Refer Department of Revenue Notification no 37/2017 dated 11th May 2017

Information :

- As per CBDT circular F. No. 370142/14/2022-TPL dated on 28th March 2023, person who has failed to intimate the Aadhaar number in accordance with section 139AA of the Income-tax Act, 1961 (the Act) read with rule 114AAA shall face the consequences of the PAN becoming inoperative.

- The consequences of PAN becoming inoperative shall not be applicable to those persons who have been exempted from linking PAN-Aadhaar.

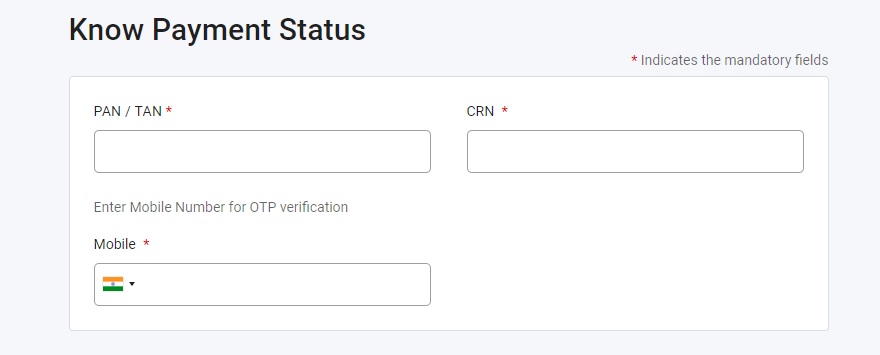

- Taxpayers who have been allotted a PAN as on 1st July 2017 and are not exempted from linking are liable to pay a non-refundable fee of Rs. 1000 for submission of PAN-Aadhaar linkage request. If linking is not done till 30th June 2023, the PAN will be marked as inoperative with effect from 1st July 2023.

- Please pay the applicable non-refundable fee of Rs. 1000 through e-Pay Tax service to proceed with submission of Aadhaar-PAN linking request. Click here for payment related information.

- Please make sure fee payment is done under Minor head 500 – Other Receipts(500) and Major head 0021 [Income Tax (Other than Companies)] in single challan.

![]()

![]()

“There is no need of downloading of the challan receipt for linking PAN with Aadhaar. Further, as soon as the PAN holder completes the payment successfully, an email with an attached copy of the challan is already being sent to the PAN holder”, the Income Tax department added.

“In cases where fee payment & consent for linking have been received, but linking has not been done till 30.06.2023, such cases will be duly considered by the Department”, the I-T department stated.