Adjudication, Prosecutions, Offences and Penalties under SCRA, 1956, the object of Securities Contracts (Regulation) Act, 1956 is to provide for the regulation of stock exchanges, and of transactions in securities dealt on them with a view to prevent undesirable speculation. The Act also seeks to regulate the buying and selling of securities outside the limits of stock exchanges, through the licensing of security dealers.

Penalties

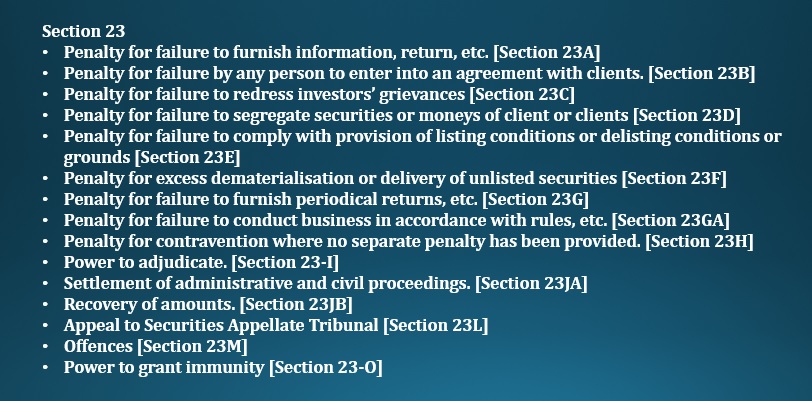

The Act prescribes various penalties against persons who might be found guilty of offences under section 23 the Act.

These offences are listed below –

Section 23.

- Any person who –

(a) without reasonable excuse (the burden of proving which shall be on him) fails to comply with any requisition made under sub-section (4) of section 6; or

(b) enters into any contract in contravention of any of the provisions contained in section 13 or section 16; or

(c) contravenes the provisions contained in section 17 or section 17A, or section 19; or

(d) enters into any contract in derivative in contravention of section 18A or the rules made under section 30;

(e) owns or keeps a place other than that of a recognized stock exchange which is used for the purpose of entering into or performing any contracts in contravention of any of the provisions of this Act and knowingly permits such place to be used for such purposes; or

(f) manages, controls, or assists in keeping any place other than that of a recognized stock exchange which is used for the purpose of entering into or performing any contracts in contravention of any of the provisions of this Act or at which contracts are recorded or adjusted or rights or liabilities arising out of contracts are adjusted, regulated or enforced in any manner whatsoever; or

(g) not being a member of a recognized stock exchange or his agent authorized as such under the rules or bye-laws of such stock exchange or not being a dealer in securities licensed under section 17 willfully represents to or induces any person to believe that contracts can be entered into or performed under this Act through him; or

(h) not being a member of a recognized stock exchange or his agent authorized as such under the rules or bye-laws of such stock exchange or not being a dealer in securities licensed under section 17, canvasses, advertises or touts in any manner either for himself or on behalf of any other persons for any business connected with contracts in contravention of any of the provisions of this Act; or

(i) joins, gathers or assists in gathering at any place other than the place of business specified in the byelaws of a recognized stock exchange any person or persons for making bids or offers or for entering into or performing any contracts in contravention of any of the provisions of this Act; shall, without prejudice to any award of penalty by the Adjudicating Officer or the Securities and Exchange Board of India under this Act, on conviction, be punishable with imprisonment for a term which may extend to ten years or with fine, which may extend to twenty-five crore rupees, or with both.

- Any person who enters into any contract in contravention of the provisions contained in section 15 or who fails to comply with the provisions of section 21 or section 21A or with the orders of or section 22 or with the orders of the Securities Appellate Tribunal shall, without prejudice to any award of penalty by the Adjudicating Officer under this Act, on conviction, be punishable with imprisonment for a term which may extend to ten years or with fine, which may extend to Rs.25 crore, or with both.

Penalty for failure to furnish information, return, etc. [Section 23A]

Any person, who is required under this Act or any rules made thereunder, –

(a) to furnish any information, document, books, returns or report to the recognized stock exchange or to the Board, fails to furnish the same within the time specified therefor in the listing agreement or conditions or byelaws of the recognized stock exchange or the Act or rules made thereunder, or who furnishes false, incorrect or incomplete information, document, books, return or report, shall be liable to a penalty which shall not be less than Rs.1 lakh but which may extend to Rs.1 lakh for each day during which such failure continues subject to a maximum of Rs.1 crore for each such failure;

(b) to maintain books of account or records, as per the listing agreement or conditions, or bye-laws of a recognized stock exchange, fails to maintain the same, shall be liable to a penalty which shall not be less than Rs.1 lakh but which may extend to Rs.1 lakh for each day during which such failure continues subject to a maximum of Rs.1 crore.

Penalty for failure by any person to enter into an agreement with clients. [Section 23B]

If any person, who is required under this Act or any bye-laws of a recognized stock exchange made thereunder, to enter into an agreement with his client, fails to enter into such an agreement, he shall be liable to a penalty which shall not be less than Rs.1 lakh but which may extend to Rs.1 lakh for each day during which such failure continues subject to a maximum of Rs.1 crore for every such failure.

Penalty for failure to redress investors’ grievances [Section 23C]

If any stock broker or sub-broker or a company whose securities are listed or proposed to be listed in a recognized stock exchange, after having been called upon by the Securities and Exchange Board of India or a recognized stock exchange in writing, to redress the grievances of the investors, fails to redress such grievances within the time stipulated by the Securities and Exchange Board of India or a recognized stock exchange, he or it shall be liable to a penalty which shall not be less than Rs.1 lakh but which may extend to Rs.1 lakh for each day during which such failure continues subject to a maximum of Rs.1 crore.

Penalty for failure to segregate securities or moneys of client or clients [Section 23D]

If any person, who is registered under section 12 of the Securities and Exchange Board of India Act, 1992 (15 of 1992) as a stock broker or sub-broker, fails to segregate securities or moneys of the client or clients or uses the securities or moneys of a client or clients for self or for any other client, he shall be liable to a penalty which shall not be less than Rs.1 lakh but which may extend to Rs.1 crore

Penalty for failure to comply with provision of listing conditions or delisting conditions or grounds [Section 23E]

If a company or any person managing collective investment scheme or mutual fund or real estate investment trust or infrastructure investment trust or alternative investment fund, fails to comply with the listing conditions or delisting conditions or grounds or commits a breach thereof, it or he shall be liable to a penalty which shall not be less than Rs.5 lakh but which may extend to Rs.25 crore.

Penalty for excess dematerialisation or delivery of unlisted securities [Section 23F]

If any issuer dematerialises securities more than the issued securities of a company or delivers in the stock exchanges the securities which are not listed in the recognized stock exchange or delivers securities where no trading permission has been given by the recognized stock exchange, he shall be liable to a penalty which shall not be less than Rs.5 lakh but which may extend to Rs.25 crore.

Penalty for failure to furnish periodical returns, etc. [Section 23G]

If a recognized stock exchange fails or neglects to furnish periodical returns or furnishes false, incorrect or incomplete periodical returns to the Securities and Exchange Board of India or fails or neglects to make or amend its rules or bye-laws as directed by the Securities and Exchange Board of India or fails to comply with directions issued by the Securities and Exchange Board of India, such recognized stock exchange shall be liable to a penalty which shall not be less than Rs.5 lakh but which may extend to Rs.25 crore.

Penalty for failure to conduct business in accordance with rules, etc. [Section 23GA]

Where a stock exchange or a clearing corporation fails to conduct its business with its members or any issuer or its agent or any person associated with the securities markets in accordance with the rules or regulations made by the Securities and Exchange Board of India and the directions issued by it under this Act, the stock exchange or the clearing corporations, as the case may be, shall be liable to penalty which shall not be less than Rs.5 crore but which may extend to Rs.25 crore or three times the amount of gains made out of such failure, whichever is higher.

Penalty for contravention where no separate penalty has been provided. [Section 23H]

Whoever fails to comply with any provision of this Act, the rules or articles or bye-laws or the regulations of the recognized stock exchange or directions issued by the Securities and Exchange Board of India for which no separate penalty has been provided, shall be liable to a penalty which shall not be less than Rs.1 lakh but which may extend to Rs.1 crore.

Power to adjudicate. [Section 23-I]

- For the purpose of adjudging under sections 23A, 23B, 23C, 23D, 23E, 23F, 23G and 23H, the Securities and Exchange Board of India may appoint any officer not below the rank of a Division Chief of the Securities and Exchange Board of India to be an adjudicating officer for holding an inquiry in the prescribed manner after giving any person concerned a reasonable opportunity of being heard for the purpose of imposing any penalty.

- While holding an inquiry, the adjudicating officer shall have power to summon and enforce the attendance of any person acquainted with the facts and circumstances of the case to give evidence or to produce any document, which in the opinion of the adjudicating officer, may be useful for or relevant to the subject-matter of the inquiry and if, on such inquiry, he is satisfied that the person has failed to comply with the provisions of any of the sections specified in subsection (1), he may impose such penalty as he thinks fit in accordance with the provisions of any of those sections.

- The Board may call for and examine the record of any proceedings under this section and if it considers that the order passed by the adjudicating officer is erroneous to the extent it is not in the interests of the securities market, it may, after making or causing to be made such inquiry as it deems necessary, pass an order enhancing the quantum of penalty, if the circumstances of the case so justify

Settlement of administrative and civil proceedings. [Section 23JA]

- Notwithstanding anything contained in any other law for the time being in force, any person, against whom any proceedings have been initiated or may be initiated under section 12A or section 23-I, may file an application in writing to the Board proposing for settlement of the proceedings initiated or to be initiated for the alleged defaults.

- The Board may, after taking into consideration the nature, gravity and impact of defaults, agree to the proposal for settlement, on payment of such sum by the defaulter or on such other terms as may be determined by the Board in accordance with the regulations made under the Securities and Exchange Board of India Act, 1992.

- For the purposes of settlement under this section, the procedure as specified by the Board under the Securities and Exchange Board of India Act, 1992 shall apply.

- No appeal shall lie under section 23L against any order passed by the Board or the adjudicating officer, as the case may be, under this section.

- All settlement amounts, excluding the disgorgement amount and legal costs, realized under this Act shall be credited to the Consolidated Fund of India.

Recovery of amounts. [Section 23JB]

- If a person fails to pay the penalty imposed under this Act or fails to comply with a direction of disgorgement order issued under section 12A or fails to pay any fees due to the Board, the Recovery Officer may draw up under his signature a statement in the specified form specifying the amount due from the person (such statement being hereafter in this Chapter referred to as certificate) and shall proceed to recover from such person the amount specified in the certificate by one or more of the following modes, namely:–

(a) attachment and sale of the person’s movable property;

(b) attachment of the person’s bank accounts;

(c) attachment and sale of the person’s immovable property;

(d) arrest of the person and his detention in prison;

(e) appointing a receiver for the management of the person’s movable and immovable properties, and for this purpose, the provisions of sections 220 to 227, 228A, 229, 232, the Second and Third Schedules to the Income-tax Act, 1961 and the Income-tax (Certificate Proceedings) Rules, 1962, as in force from time to time, in so far as may be, apply with necessary modifications as if the said provisions and the rules thereunder were the provisions of this Act and referred to the amount due under this Act instead of to income-tax under the Income-tax Act, 1961.

- The Recovery Officer shall be empowered to seek the assistance of the local district administration while exercising the powers under sub-section (1).

- Notwithstanding anything contained in any other law for the time being in force, the recovery of amounts by a Recovery Officer under sub-section (1), pursuant to non-compliance with any direction issued by the Board under section 12A, shall have precedence over any other claim against such person.

- For the purposes of sub-sections (1), (2) and (3), the expression “Recovery Officer” means any officer of the Board who may be authorized, by general or special order in writing to exercise the powers of a Recovery Officer.

Appeal to Securities Appellate Tribunal [Section 23L]

- Any person aggrieved, by the order or decision of the recognized stock exchange or the adjudicating officer or any order made by the Securities and Exchange Board of India under or sub-section (3) of section 23-I, may prefer an appeal before the Securities Appellate Tribunal and the provisions of sections 22B, 22C, 22D and 22E of this Act, shall apply, as far as may be, to such appeals.

- Every appeal under sub-section (1) shall be filed within a period of forty-five days from the date on which a copy of the order or decision is received by the appellant and it shall be in such form and be accompanied by such fee as may be prescribed: Provided that the Securities Appellate Tribunal may entertain an appeal after the expiry of the said period of forty-five days if it is satisfied that there was sufficient cause for not filing it within that period.

- On receipt of an appeal under sub-section (1), the Securities Appellate Tribunal may, after giving the parties to the appeal, an opportunity of being heard, pass such orders thereon as it thinks fit, confirming, modifying or setting aside the order appealed against.

- The Securities Appellate Tribunal shall send a copy of every order made by it to the parties to the appeal and to the concerned adjudicating officer.

- The appeal filed before the Securities Appellate Tribunal under sub-section (1) shall be dealt with by it as expeditiously as possible and endeavor shall be made by it to dispose of the appeal finally within six months from the date of receipt of the appeal.

Offences [Section 23M]

1.Without prejudice to any award of penalty by the adjudicating officer or the Securities and Exchange Board of India] under this Act, if any person contravenes or attempts to contravene or abets the contravention of the provisions of this Act or of any rules or regulations or bye-laws made thereunder, for which no punishment is provided elsewhere in this Act, he shall be punishable with imprisonment for a term which may extend to ten years, or with fine, which may extend to Rs.25 crore rupees or with both.

2. If any person fails to pay the penalty imposed by the adjudicating officer or the Securities and Exchange Board of India] or fails to comply with the direction or order, he shall be punishable with imprisonment for a term which shall not be less than one month but which may extend to ten years, or with fine, which may extend to Rs.25 crore, or with both.

Power to grant immunity [Section 23-O]

- The Central Government may, on recommendation by the Securities and Exchange Board of India, if the Central Government is satisfied, that any person, who is alleged to have violated any of the provisions of this Act or the rules or the regulations made thereunder, has made a full and true disclosure in respect of alleged violation, grant to such person, subject to such conditions as it may think fit to impose, immunity from prosecution for any offence under this Act, or the rules or the regulations made thereunder or also from the imposition of any penalty under this Act with respect to the alleged violation:

Provided that no such immunity shall be granted by the Central Government in cases where the proceedings for the prosecution for any such offence have been instituted before the date of receipt of application for grant of such immunity: Provided further that the recommendation of the Securities and Exchange Board of India under this sub-section shall not be binding upon the Central Government.

- An immunity granted to a person under sub-section (1) may, at any time, be withdrawn by the Central Government, if it is satisfied that such person had, in the course of the proceedings, not complied with the condition on which the immunity was granted or had given false evidence, and thereupon such person may be tried for the offence with respect to which the immunity was granted or for any other offence of which he appears to have been guilty in connection with the contravention and shall also become liable to the imposition of any penalty under this Act to which such person would have been liable, had not such immunity been granted.

Important link : click here

pre examination test