ANNUAL COMPLIANCE CALENDAR-PRIVATE LIMITED COMPANY

ANNUAL COMPLIANCE CALENDAR -PRIVATE LIMITED COMPANY

MEANING OF A PRIVATE COMPANY:

As per Section 2(68) “Private Company” means a Company, which by its Article, -

(I) restricts...

Bulletins from Nirmala Sitharaman press conference- in view of COVID 19 chaos

Bulletins from Nirmala Sitharaman press conference- in view of COVID 19 chaos

Finance Minister Smt. Nirmala Sitharaman, contemplating the present state of affairs within the...

Due dates for GST Returns & IT Returns for June & July 2020

Due dates for GST Returns and Income Tax Returns for the Month of June 2020 and July 2020- As prolonged

The Month of June and...

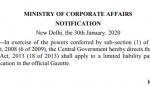

Amnesty Scheme for Condonation of delay- Now Relevant to LLPs as nicely

LLP annual filings:

Each Restricted Legal responsibility Partnerships (LLPs) is required to file its annual return inside 60 days from the top of the monetary...

GUIDANCE NOTE ON AOC-4

Guidance Note on AOC-4 intends to explain various features relating Guidance Note on AOC-4 to financial statements under the Companies Act, 2013. MCA form...

Dates extended for annual Filing Forms: AOC-4, AOC-4 XBRL, etc

Ministry of Corporate Affairs extended the Dates for annual Filing Forms. Circular content is given below:

Subject: Relaxation on levy of additional fees in filing...

MCA UPDATE Relaxation on levy of additional fees

Relaxation on levy of additional fees is given till 15.02.2022 for filing of e-forms AOC-4, AOC-4 (CFS), AOC-4, AOC-4 XBRL AOC-4 Non-XBRL and 28.02.2022...