Trading Window closure period under Clause 4 of Schedule B read with Regulation 9 of SEBI (Prohibition of Insider Trading) Regulations, 2015 (“Prohibition of Insider Trading Regulations”)

Execute trades 1. Clause 4 (1) of Schedule B read with Regulation 9 of Prohibition of Insider Trading Regulations. It states that “Designated persons may execute trades subject to compliance with these regulations. Towards this end, a notional trading window shall be used as an instrument of monitoring trading by the designated persons.

Trading window shall be closed The trading window shall be closed when the compliance officer determines. That a designated person or class of designated persons can reasonably be expected to have possession of unpublished price sensitive information. Such closure shall be imposed in relation to such securities to which such UPSI relates. Designated persons and their immediate relatives shall not trade in securities when the trading window is closed”.

made applicable 2. One of the instances of closure of trading window is provided in Clause 4 (2) of Schedule B read with Regulation 9 of Prohibition of Insider Trading Regulations. Which inter-alia states that “trading restriction period shall be made applicable from the end of every quarter till 48 hours after the declaration of financial results”.

rationalize the compliance requirement 3. In order to rationalize the compliance requirement under Clause 4 of Schedule B read with Regulation 9 of Prohibition of Insider Trading Regulations. It improves ease of doing business and prevent inadvertent non-compliances of provisions of Prohibition of Insider Trading Regulations by DPs, after having deliberations with Stock Exchanges and Depositories and listed companies, it has been decided that Stock Exchanges and Depositories shall develop a system to restrict trading by DPs of listed company during trading window closure period.

applicable to declaration of financial results 4. To begin with, the provisions of this circular shall be applicable to declaration of financial results of the listed company that is or was part of benchmark indices i.e. NIFTY 50 and SENSEX from the date of implementation of this circular.

Further, to begin with, the restriction on trading shall be for on-market transactions, off-market transfers and creation of pledge in equity shares and equity derivatives contracts (i.e. Futures and Options) of such listed companies.

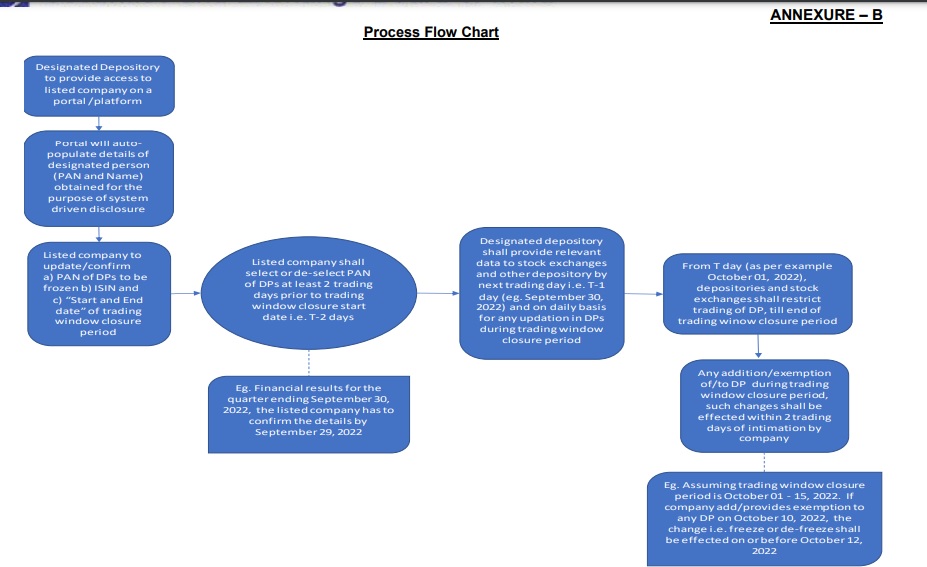

Procedure 5. The procedure for implementation of the system is enclosed at Annexure- A. The flow chart of the same is enclosed at Annexure – B.

Come into Force 6. Come into force with effect from the quarter ending September 30, 2022.

independently comply with the obligations 7. The Compliance Officer and DPs of listed companies shall continue to independently comply with the obligations under Prohibition of Insider Trading Regulations, as applicable to them, till further communication.

Directed 8. The Depositories and Stock Exchanges are directed to:-

8.1. take necessary steps to put in place systems for implementation of this circular.

8.2. bring the provisions of this circular to the notice of all listed companies and also disseminate the same on their websites.

issued in exercise of the powers 9. This circular is issued in exercise of the powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992, read with Regulations 4(3) and 11 of the PIT Regulations, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

Copy 10. A copy of this circular is available on SEBI website at www.sebi.gov.in under the

categories “Legal Circulars”.

Enclosure:

1. Procedure for implementation of the system

2. Process flow chart

Trading Window closure period under Clause 4 of Schedule B read with Regulation 9 of SEBI (Prohibition of Insider Trading) Regulations, 2015 (“Prohibition of Insider Trading Regulations”) – Framework for restricting trading by Designated Persons (“DPs”) by freezing PAN at security level Process for implementation of the system:

1. Appointed:

The Designated Depository (“DD”) appointed by the listed company pursuant to the SEBI Circular No. SEBI/HO/CFD/DCR1/CIR/P/2018/85 dated May 28, 2018 shall enable access to the respective listed company on the portal/ platform.

2. auto-populate:

Upon login, DD shall auto-populate PAN and name of the DPs and their demat account number / DP ID and client ID (only in case of PAN exempt cases) as per the last updated or available information under system-driven disclosure uploaded by the listed company with DD in terms of SEBI Circular No. SEBI/HO/ISD/ISD/CIR/P/2020/168 dated September 09, 2020.

3. Confirm to the DD details:

The listed company shall confirm to the DD details with respect to listed ISIN of equity share of the company, Name, PAN, and confirm the demat account number viz. DP ID and client ID (in case of PAN exempted cases) of DPs.

In the event any updation is required to the aforementioned details, the listed company shall take necessary steps as per para 10 below.

4. Trading Window Closure Period:

DD shall provide a facility to the listed company to specify the ‘Trading Window Closure Period’ i.e. ‘Commencement Date’ and ‘End Date’ on portal/platform.

4.1. With respect to financial results, the listed company shall specify the 1st day (T- day) immediately after the end of every quarter for which results are to be announced as ‘Trading Window Closure commencement date’ and the date on which 48 hours ends post disclosure of financial results as ‘Trading Window Closure End date’ in the portal/platform.

5. Trading window closure date (T-2 days):

The listed company shall provide the aforesaid details at least 2 trading days prior to the commencement of trading window closure date (T-2 days).

For example, for financial results for the quarter ending September 30, 2022, the listed company shall confirm the details by September 29, 2022.

6. Details received from the listed company:

DD shall provide the details received from the listed company (i.e. Commencement Date and End Date of the trading window closure period, Name and PAN of DPs, ISIN, etc.) to the Stock Exchanges and other Depository atleast 1 trading day prior to the commencement of trading window closure commencement date (T-1 day).

For example, for financial results for the quarter ending September 30, 2022, the DD shall provide the details by September 30, 2022. Further, during the trading window closure period, DD shall also provide the aforesaid details and changes therein, if any, to the Stock Exchanges and other Depository on a daily basis.

7. Identified:

The demat accounts shall be identified by the depositories based on the PAN of the DP of Sole / joint holder.

8. Restricted:

Based on demat accounts identified as per para 7 above and instruction given by listed company as per paras 3 and 4 above, the off-market transactions and creation of pledge shall be restricted by the Depositories with reason code as “Trading Window Closure Period”.

9. Data received from the Depositories:

On the basis of data received from the Depositories, the Stock Exchanges shall restrict the on-market transactions of DPs in equity shares and equity derivatives contracts of the listed company from T day i.e. Commencement Date of trading window closure period. As per the example mentioned above, Commencement Date of trading window closure period shall be October 01, 2022, for the quarter ending September 30, 2022.

10. Details of DP:

In case of any addition/deletion/updation pertaining to the details of DP, the listed company has to follow the procedure specified in terms of SEBI Circular No. SEBI/HO/ISD/ISD/CIR/P/2020/168 dated September 09, 2020 and shall be required to separately provide the details as mentioned at paras 3 and 4 above. Such instances shall be effected within 2 trading days of receipt of intimation from the listed company. For example, assuming the trading window closure period is October 01 – 15, 2022 and if the listed company adds any DP on October 10, 2022, then the change i.e. freeze shall be effected on or before October 12, 2022.

11. specify the details of DP:

There shall be provision in the system to specify the details of DP to be exempted by listed company from Trading Window restriction in terms of Clause 4 (3) of Schedule B read with regulation 9 of PIT Regulations.

Restriction shall be removed

In such cases, the restriction shall be removed within 2 trading days from the date of receipt of request from the listed company.

Example

As per the example given at para 10 above, if the listed company provides exemption to any DP on October 11, 2022, then the change i.e. de-freeze shall be effected on or before October 13, 2022.

The restrictions shall be re-introduced automatically post lapse of the exemption period or completion of the transaction by the DP.

12. PAN at the security level:

The freezing/de-freezing of PAN at the security level on account of changes due to addition or deletion will be effected post market hours.

13. Pay-in and pay-out obligations:

Pay-in and pay-out obligations in respect of transactions, if any, taken place prior to freezing the PAN of DP at the security level, may be permitted to be settled, squared off or closed out, as the case may be.

14. formats and timelines for sharing of data:

The formats and timelines for sharing of data shall be standardized, as agreed upon by the Depositories and Stock Exchanges.

Further, operational guidelines for listed companies shall be issued by the Depositories.

15. Discrepancy:

In case of any discrepancy, the issue shall be resolved by the Depositories, in coordination with Stock Exchanges and listed company.

Restricting trading by DPs during Window Closure Period

Insolvency and Bankruptcy Code, 2016

Important : https://myaadhaar.uidai.gov.in/check-aadhaar

[…] Restricting Trading by DPs by freezing PAN at security level […]

[…] Restricting Trading by DPs by freezing PAN at security level […]

[…] Restricting Trading by DPs by freezing PAN at security level […]

Comments are closed.