Several times, it may happens that a lot from user gets stuck while opening the PDF, which user has downloaded or received from the various government sites like Income Tax Department or TDS site. These sites contain several documents which are password protected for security reasons. The PDF downloaded / received from these types of various websites, are required passwords to open the documents. In this article, you will get to know about how to get / decode the password for Form 16A for TDS to file Income Tax Return.

What is Form 16A?

- Like Form 16, Form 16A is also a TDS certificate.

- Form 16A is an acknowledgement receipt that shows the tax that has been deducted from income other than salary of employees by the employer and the same has been deposited with the Income Tax Department.

- Form 16A is issued when the TDS deduction is made for the income from fixed deposits in the bank or TDS deducted on your rent receipts, TDS deducted on insurance commission, etc.

- Hence, when TDS is deducted on any other income you receive that is liable for such deduction, Form 16A is issued .

- Just like Form 16, Form 16A also contains the details of deductor and deductee, like name and address, details of PAN and details of TAN, also the amount of TDS deducted and deposited with the government.

- All TDS details whatever are there in Form 16A are available on Form 26AS.

How to get Form 16A- for TDS on income other than salary?

- Who person deducts the TDS, it is mandatory for the him to issue TDS certificate in form 16A to the deductee.

- Once the deductor submitted the details of TDS in Form 26AS and deposits the TDS, he/she can download Form 16A online. Form 16A can be downloaded from TRACES website.

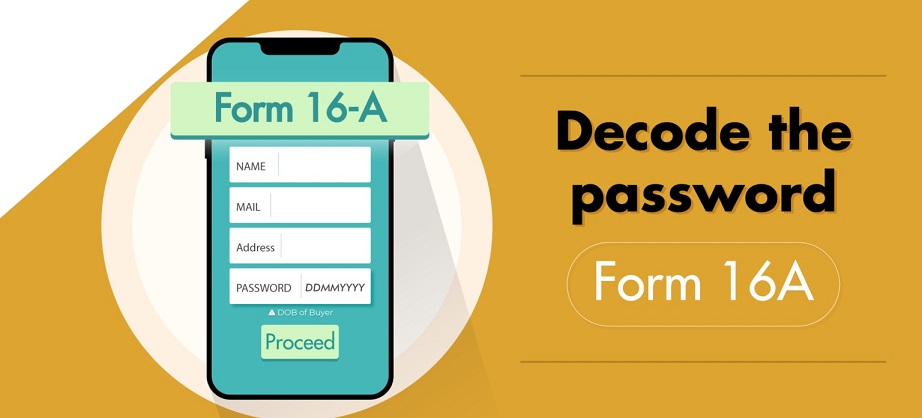

What is the password or how to get the password for Form 16A?

- For security reasons, Form 16A is always password protected.

- To know the password for the Form 16A, you have to use the combination of first 5 characters of the PAN number in uppercase/capital letters and Date of Birth of the employee in DDMMYYYY format.

- That means if employee PAN number is ABCDE1234L and the employee date of birth is 11th December, 2022, then the password for Form 16A would be ABCDE11122022.

Form 16A is very important for taxpayers as this form helps the taxpayers in filing their income tax return smoothly. Form 16A also helps in verifying the income, income details and also the rate at which the TDS has been deducted. To avoid any problem or sort of inconstancy when filing income taxes, in 2022, it is compulsory for the taxpayers to get the details about Form 16, Form 16A and other Forms and use them accordingly.