GUIDANCE NOTE ON AOC-4

Guidance Note on AOC-4 intends to explain various features relating Guidance Note on AOC-4 to financial statements under the Companies Act, 2013. MCA form...

DIR 3 KYC (DIRECTOR KYC)

Introduction: The Ministry of Corporate Affairs (MCA) has introduced the DIR-3 Web KYC process, which enables directors of Indian companies to complete their Know Your...

Link Status PAN Aadhaar Card, challan payment is successful

PAN Aadhaar Card Link Status : The Income Tax Department said that it will consider the cases where the fee payment and consent for...

Form 24Q: TDS Return on Salary Payment

The employers have several responsibilities towards employees , one of which is to deduct TDS on behalf of them. An employer has to file...

CITIZENSHIP Article 5-11

Citizenship at the commencement of the Constitution, Rights of citizenship of certain persons who have migrated to India from Pakistan, Rights of citizenship of...

MCQ for Pre Test- Corporate Restructuring, Valuation and Insolvency

PROFESSIONAL PROGRAMME (New syllabus) CORPORATE RESTRUCTURING, VALUATION AND INSOLVENCY, Corporate Applicant Means A person in favour of whom security interest is created. Corporate Restructuring,...

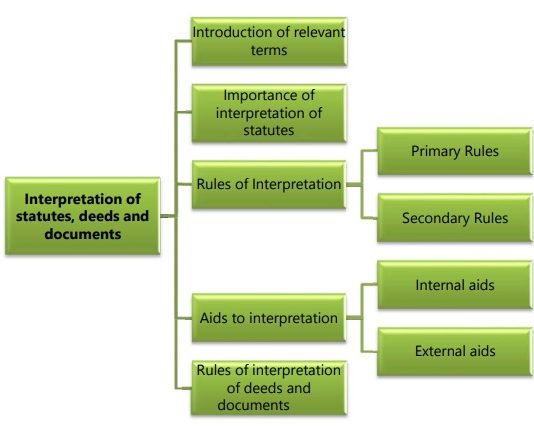

Pleadings Rules and Amendments

Pleadings are the backbone of legal profession. It is the foundation stone on which case of a party stands. The case of a party...

Due Date of Income Tax Return ITR Filing

Meaning of the due date as per income tax?

Specified persons are required to file ITR with the income tax department after the end of each financial year. To...

Written statement of plaint

Written Statement of Plaint is a defense statement comprising all material facts ad other details against the plaint. A legal document stating the cause...